In today’s fast-paced business environment, managing accounts receivable efficiently is more crucial than ever. With the advent of accounts receivable management software, businesses of all sizes are finding it easier to streamline their billing processes, improve cash flow, and reduce the time spent on manual tasks. This cutting-edge technology not only automates invoice creation and payment tracking but also offers detailed analytics to help companies make informed financial decisions.

Accounts Receivable Management Software

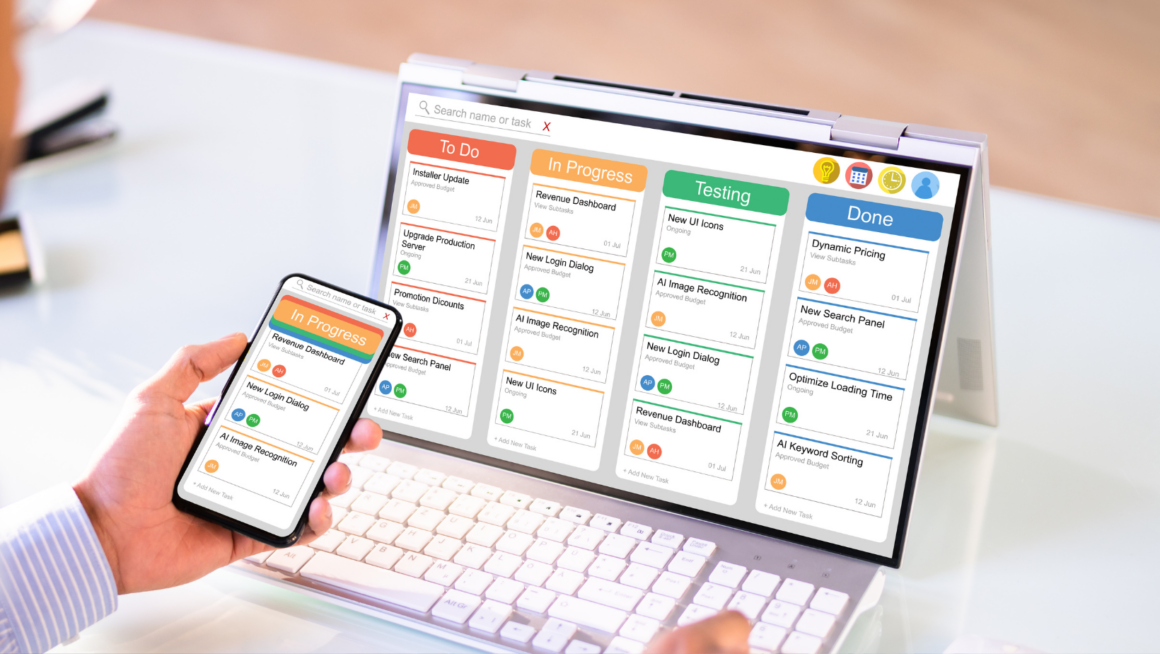

Accounts receivable management software streamlines the process of managing invoices and payments, crucial for maintaining a healthy cash flow. It automates the billing cycle, reducing manual bookkeeping and the risk of human error. This software enables businesses to track invoices efficiently, send reminders for overdue payments, and generate reports that offer insights into financial health. Implementing such a system improves the accuracy of billing, thus enhancing customer satisfaction. Additionally, the analytics provided by accounts receivable management software help in making informed financial decisions, further optimizing business operations. By facilitating smoother financial transactions, this software supports companies in achieving better financial efficiency and relations with their clients, building upon the importance of innovative financial tools in today’s competitive market.

Evaluating the Benefits of Automation

In the realm of accounts receivable management, the transition to automation through sophisticated software brings a host of benefits that directly impact business efficiency and financial health. Key among these advantages is the automation of repetitive tasks. Automated invoicing and payment tracking streamline operations, freeing up time for staff to focus on more strategic efforts. This shift not only enhances productivity but also significantly reduces the likelihood of human error, ensuring more accurate billing and financial records.

In the realm of accounts receivable management, the transition to automation through sophisticated software brings a host of benefits that directly impact business efficiency and financial health. Key among these advantages is the automation of repetitive tasks. Automated invoicing and payment tracking streamline operations, freeing up time for staff to focus on more strategic efforts. This shift not only enhances productivity but also significantly reduces the likelihood of human error, ensuring more accurate billing and financial records.

Additionally, the implementation of accounts receivable management software offers unparalleled visibility into the financial workings of a company. With comprehensive analytics and reporting features, businesses gain critical insights into payment behaviors, cash flow trends, and potential bottlenecks. This data-driven approach aids in making informed decisions, facilitating the identification of opportunities for further optimization.

By ensuring timely invoicing and follow-ups on overdue payments, automation software plays a pivotal role in improving cash flow—a crucial aspect for any business’s sustainability and growth. Furthermore, the streamlined communication facilitated by these platforms enhances customer satisfaction, setting the stage for stronger business relationships and repeat business.

Top Accounts Receivable Management Software Solutions

Navigating the realm of accounts receivable management, businesses seek software solutions that epitomize efficiency, accuracy, and innovation. Among the plethora of options available, a few stand out for their comprehensive features and robust performance.

- FreshBooks: Renowned for its user-friendly interface, FreshBooks facilitates seamless invoicing, payment tracking, and generates insightful financial reports, making it a favorite among small to medium-sized enterprises.

- QuickBooks: A powerhouse in financial management, QuickBooks offers extensive accounts receivable functionalities, including automated billing, real-time tracking, and integrations with various payment gateways.

- Xero: Praised for its cloud-based approach, Xero provides real-time financial insights, automated invoice reminders, and easy reconciliation features, catering to the needs of businesses of all sizes.

- Sage 50 cloud: Combining traditional accounting software with cloud mobility, Sage 50 cloud supports detailed cash flow analysis, invoice management, and customer payment tracking, tailored for growing businesses.

Each of these solutions brings a unique set of tools to the table, enabling businesses to enhance their financial operations and stay ahead in a competitive market. By leveraging the capabilities of these top accounts receivable management software solutions, companies can streamline their processes, improve cash flow, and build stronger customer relationships.

Best Practices for Implementing Accounts Receivable Software

Adopting accounts receivable management software is a strategic move that propels businesses toward operational excellence and financial robustness. By choosing the right solution, whether it’s FreshBooks for its user-friendly interface, QuickBooks for its comprehensive financial tools, Xero for its cloud-based accessibility, or Sage 50cloud for its advanced analytics, companies can significantly improve their invoicing and payment processes. However, the key to maximizing these benefits lies in proper implementation. Training staff, customizing features to fit specific business needs, and regularly reviewing financial analytics are crucial steps. These practices ensure that businesses not only keep pace with the competitive market but also set new benchmarks for financial efficiency and customer satisfaction. With the right approach, accounts receivable management software becomes more than a tool—it becomes a game-changer in the way companies manage their finances.

Adopting accounts receivable management software is a strategic move that propels businesses toward operational excellence and financial robustness. By choosing the right solution, whether it’s FreshBooks for its user-friendly interface, QuickBooks for its comprehensive financial tools, Xero for its cloud-based accessibility, or Sage 50cloud for its advanced analytics, companies can significantly improve their invoicing and payment processes. However, the key to maximizing these benefits lies in proper implementation. Training staff, customizing features to fit specific business needs, and regularly reviewing financial analytics are crucial steps. These practices ensure that businesses not only keep pace with the competitive market but also set new benchmarks for financial efficiency and customer satisfaction. With the right approach, accounts receivable management software becomes more than a tool—it becomes a game-changer in the way companies manage their finances.